How To Move Your Money Abroad (Without Breaking The Law)

What every American should know before banking across borders

I opened my first foreign bank account in 2008.

I was 21, on a working holiday in Australia, and I needed an account for my paycheck to land.

It was incredibly easy to do.

A few years later I lived in China for a couple of months.

I tried to open an account the same way I did in Australia.

Impossible.

As I was “just an intern” there with no special status, and there was no way for me to get one.

It was the first time where I got curious about how banking abroad works.

I didn’t understand why something (in my view) so “simple” as having a bank account is such a hassle, once you leave your home country.

2020, I emigrated to Cyprus.

At the time, I had a few bank and brokerage accounts in Germany, and Wise as my first “international” banking layer.

Since then I’ve opened accounts in more countries, bought real estate abroad, set up hardware wallets for crypto, and made plenty of mistakes along the way.

I wrote about some of them here.

Now, my money sits in 7 countries.

What I want to talk about today is:

How to think about your money when you live in another country

What can break (and what catches people off guard)

What still works fine from overseas

Let’s get into it.

Disclaimer

Before we go further.

I’m not a tax advisor. I’m not a financial planner. I’m not a lawyer. I don’t manage money for a living and I don’t want to.

What I am is someone who’s lived abroad for years, built a financial setup that works across borders, and spent years figuring out how the pieces fit together.

This article is a framework. A way to think about your money when you live abroad. It’s not a set of instructions to go act on Monday morning.

Your situation is different from mine. Different from your friend. Different from that guy on the forum who swears he has figured it all out (and then tells you to use his referral code).

Before you move money, change accounts, or restructure anything: talk to a qualified professional who understands expat life.

Cool? Cool.

Let’s keep going.

Two Principles

There are two ideas that changed how I think about money abroad.

Or about life in general.

They are simple, but many ignore them until something goes wrong.

Principle 1: Never have a single point of failure.

Most Americans have one bank, in one country, in one currency.

All their retirement accounts with one custodian.

They have one residency (their US presence).

You would never put your entire retirement into a single stock.

So why keep your entire financial life in a single country?

Principle 2: Set it up before you need it.

Opening a banking structure abroad is easier when nothing is “on fire”.

Residency works the same way.

The best time to get it is when you don’t need it.

Banking is no different.

Have options before you need them.

What Is Your Moving Abroad Strategy?

Before I change anything in my life, I ask myself “what strategy does this fit”?

Because everything comes back to this question.

In the case of moving abroad, the fact is, that not everyone moves abroad “the same way”.

Some people sell their house, cancel their lease, forward their mail, and leave.

This is what is called “Full Expat”.

Others keep a foot in both places (“Snowbird”).

Six months here, six months there.

And some are just “testing” living abroad.

Three months in Portugal, maybe a winter in Mexico.

Still filing taxes from their home state and getting mail at their house.

Each of these looks completely different from a banking and money perspective.

If you keep a US residential address, most of you might worry about doesn’t even apply.

Friction starts when you go fully abroad.

That is when banks get nervous and start asking questions.

Someone going abroad, someone who has the audacity to leave their home country, and trying to use banking services from another country?

Most banks don’t like that.

So as you read the rest of this, keep your own strategy in mind.

Some of this will apply to you right now.

Some of it won’t apply for years.

Some of it might never apply.

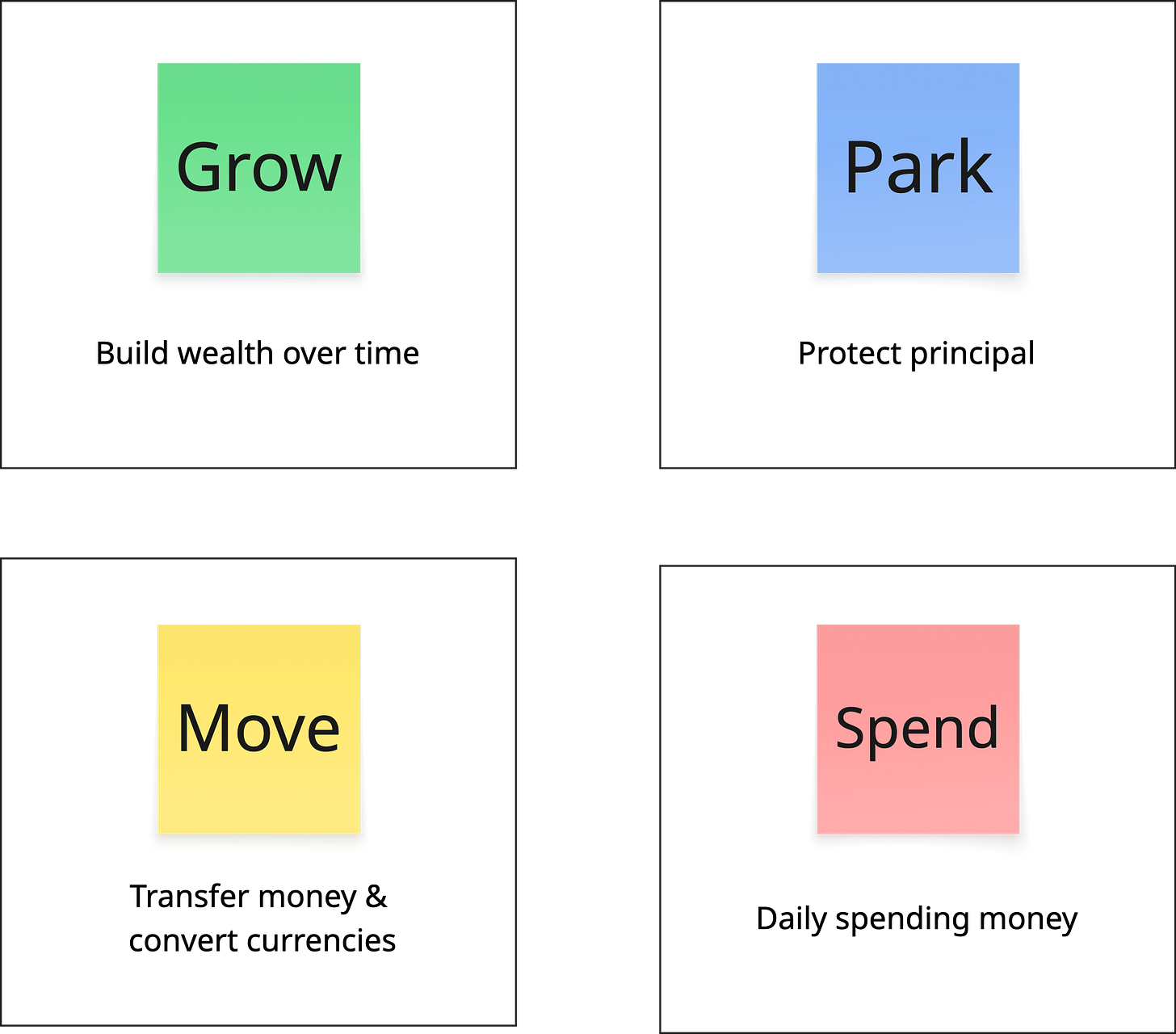

The 4 Roles Of Money

Every dollar you have is doing one of four things.

Whether you think about it that way or not.

GROW

Build wealth over time. This is your 401(k), your IRA, your brokerage account, maybe rental property.

Principal is at risk.

It goes up, it goes down.

Usually you are not touching it for years.

PARK

Protect what you’ve got.

Savings accounts, CDs, term deposits. Nothing exciting.

You won’t wake up to minus 10% on a Tuesday.

That’s the point.

MOVE

Get money from A to B.

Convert currencies. This is the “plumbing”.

In the US you have Venmo, Zelle, bank-to-bank transfers.

Used to move money, not to store it.

SPEND

Walking around money.

Checking account, debit card, ATM.

Money that’s actively going out the door.

What you probably have today:

Your GROW money is in retirement accounts and maybe a brokerage.

Your PARK money is in a savings account.

Your MOVE money runs through domestic tools that stop at the border.

Your SPEND money is in checking with a US debit card.

This works fine when you live in the US.

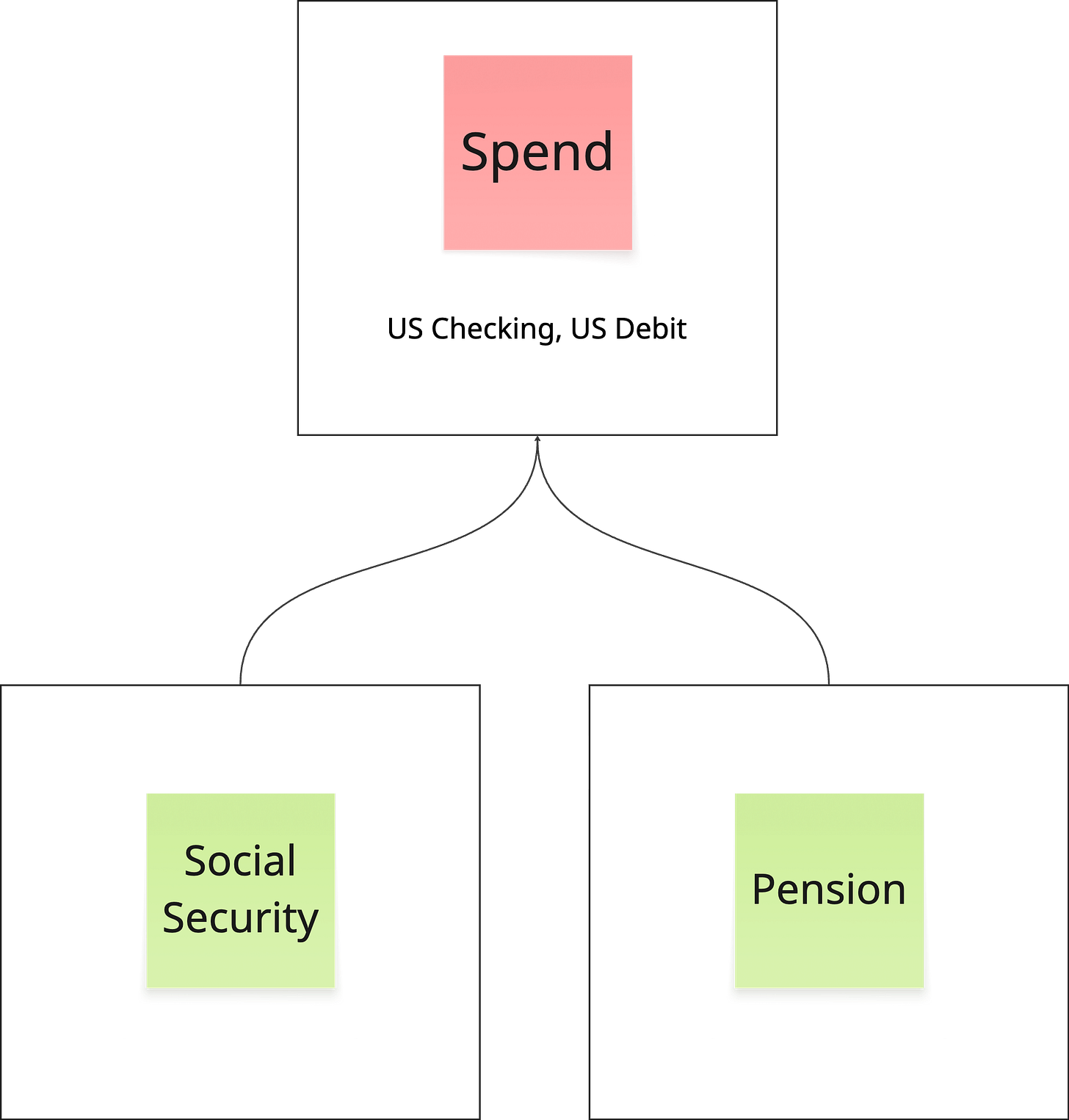

One thing people get confused about: Social Security and pensions.

Those are income sources.

The government or your former employer sends you money each month.

That money lands in SPEND.

From there, the four roles apply.

If you are an American 50+ and want to emigrate within the next 0-5 years, and don’t want to navigate healthcare, banking, visas, taxes and country selection by yourself, reply to this mail with “Retire”.

You’ll get an invite to the “Retire Abroad Priority List” with some of my best tactics for retiring abroad.

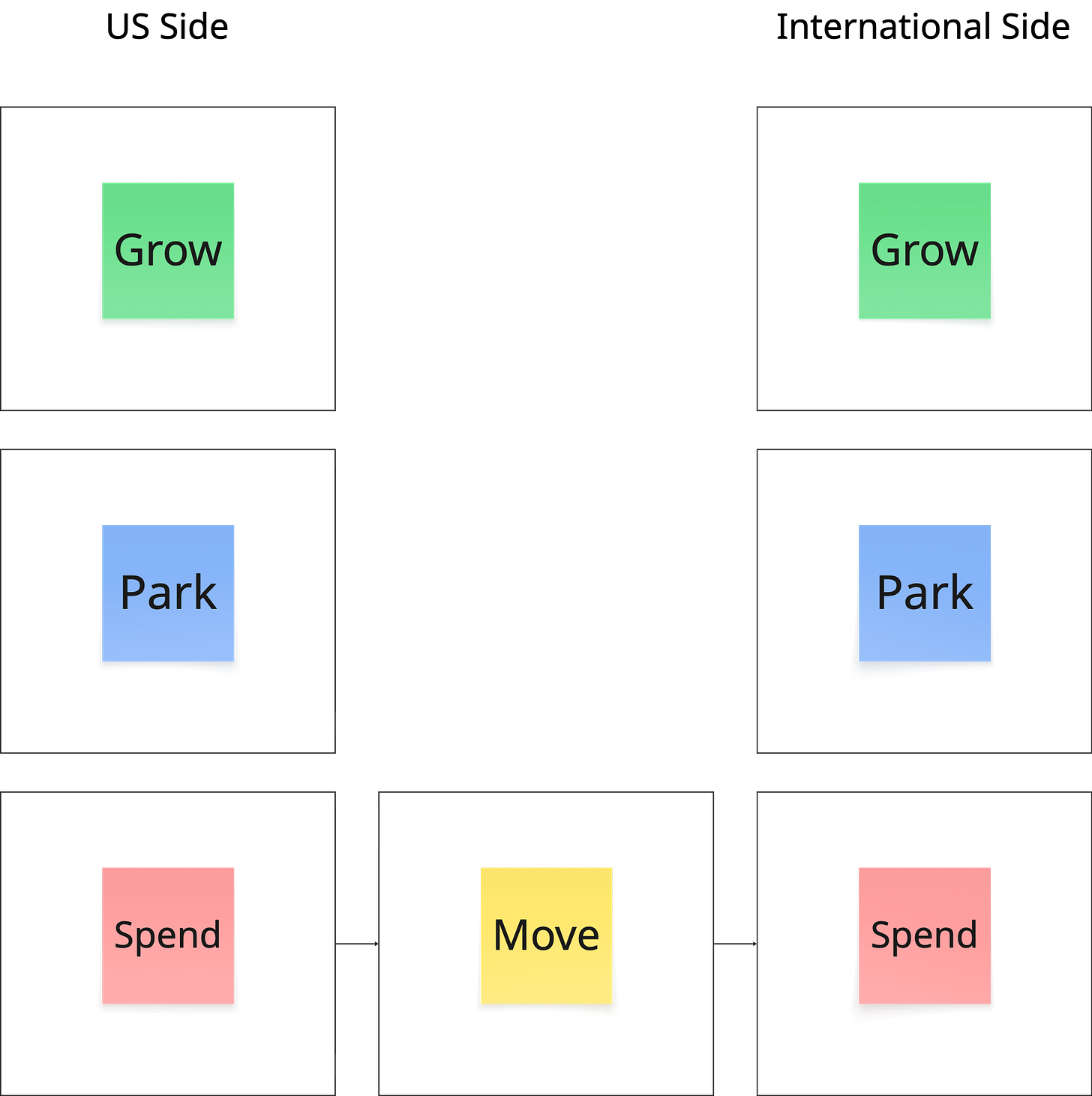

What Changes When You Cross The Border

The US side of that equation doesn’t have to disappear when you move abroad.

What changes is how you access that money, how it gets to you, and what your new country “thinks” about it.

The money can stay in the US, or it can go abroad.

“Can stay” doesn’t mean “has to stay.”

Some people move retirement money into a self-directed IRA with an offshore custodian.

Some keep retirement money with an expat friendly custodian.

And there’s no single right answer which of those is better.

It depends on your strategy, your tax situation, and your comfort level.

However, in my personal opinion (not tax or investment advice) a good global money setup is somewhat spread out.

Think of it as two sides running at the same time.

The US side is what you already have. Accounts, retirement money, savings. Some of it will stay, and maybe needs to be re-arranged.

The international side is what you build. What that looks like depends entirely on your situation.

There’s no template that fits all equally.

But to give you an idea of what’s possible: