Norway Is Deporting $250,000 Second Passport Holders

4 questions to ask before you buy a second passport

Oslo Airport, November 2025.

Two travelers step off a flight with Dominican passports.

They entered Norway the year before using the same documents without issues.

This time, officers pulled them aside.

They were separated and questioned individually.

Officers asked how they obtained citizenship, why they didn’t collect their passports directly from Dominica, and why they carried both their original documents and their CBI passports.

Then there were told they are being deported the next morning.

Their passports were confiscated overnight.

They spent the night in a hotel.

The next day, they were escorted back to the airport and put on a plane out.

Their passports were valid.

Dominica is on the Schengen visa-free list.

They had visa-free access on paper.

But none of that mattered.

Norway had decided that citizenship-by-investment passports were “not valid.”

No official policy change.

Just deportation at the border.

These two weren’t the first.

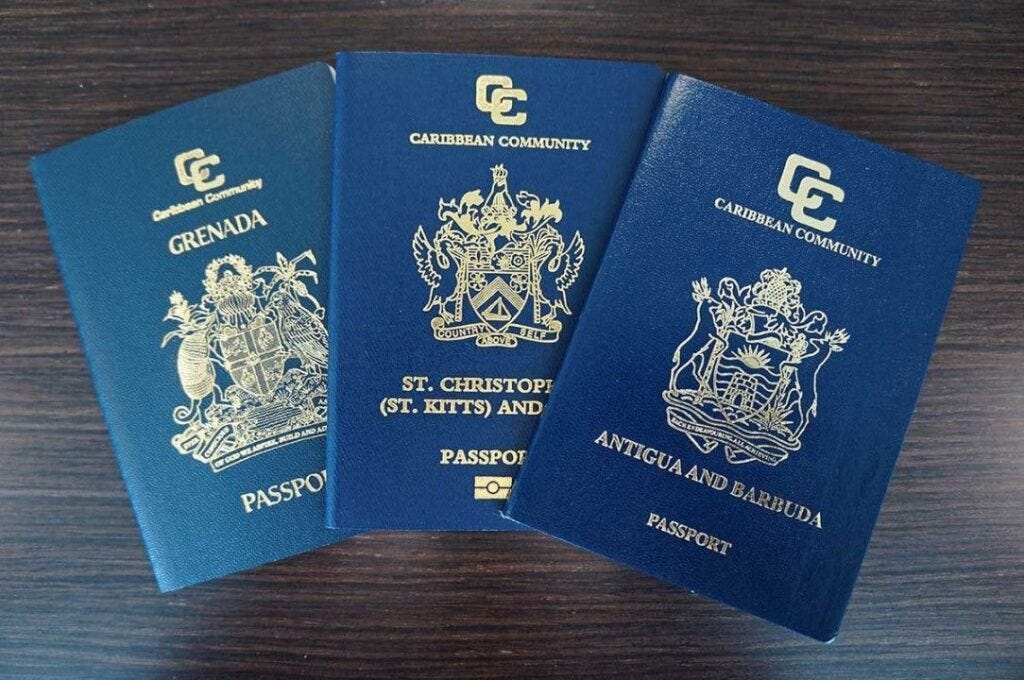

Since summer 2025, Norway has turned away passport holders from St. Kitts, Dominica, Antigua, Grenada, and St. Lucia. All 5 Caribbean CBI nations.

When lawyers asked Norwegian authorities about the denials, officials said there had been “no recent changes” to visa policy.

That was technically true.

The policy hadn’t changed.

But the enforcement had.

Here’s what we’ll cover today:

How citizenship-by-investment became a $22 billion industry built on a 41-year promise

Why that promise is now cracking (and Norway is just the beginning)

What this means if you are considering a second passport (which can cost several hundred thousand dollars)

The 41 Year Promise

St. Kitts and Nevis gained independence from Britain in 1983.

Population: under 50,000. Main export: sugar.

The problem: global sugar prices had collapsed, and the island had no other industry to fall back on.

One year later, the government created something new.

A legal pathway to citizenship in exchange for an economic contribution.

No ancestry required.

Invest in St. Kitts, become a citizen, travel the world.

The passport delivered.

Visa-free access to the UK.

Visa-free access to Canada.

Eventually to Schengen.

A real travel document from a real country, through a real legal process.

Dominica followed in 1993.

Citizenship for $100,000 to a government fund.

No visit required.

By the 2000s, both programs had operated for over a decade without scandal. St. Kitts processed thousands of applications. Dominica did the same.

Both delivered exactly what they promised.

Then came the next wave.

Antigua and Barbuda launched in 2013.

Grenada launched the same year with a specific advantage:

E-2 treaty access to the United States, meaning holders could live and work in America through an investor visa.

St. Lucia joined in 2015.

Europe got interested too.

Malta created a European option in 2014. Cyprus started selling EU passports in 2013.

Even Vanuatu, a Pacific island most people couldn't find on a map, started selling passports

By 2023, the industry generated roughly $22 billion per year.

Governments earned revenue. Applicants earned mobility.

Lawyers, agents, and due diligence firms built entire practices around the process.

St. Kitts had been running for 40 years.

Through 9/11, the 2008 crash, COVID.

Still operating.

When someone wired $200,000 to $300,000 to a Caribbean government, they bought into a system that had never betrayed them.

Takeaway: Forty-one years of trust built the CBI industry. That trust is now being tested.

If you’re an American 50+ with a meaningful retirement nest egg and you’re seriously thinking about retiring abroad in the next 0–5 years, hit reply and write “RETIRE”.

The Cracks

Vanuatu was first.

In early 2022, the EU began suspending visa-free access.

By February 2023, all Vanuatu passport holders needed visas to enter Europe.

The reason:

Vanuatu had issued passports to sanctioned individuals.

Well.

When you're processing thousands of $130,000 applications per year, someone's going to cut corners.

If HSBC can launder cartel money, why would anyone expect a 70,000-person island nation to have perfect due diligence?

The EU gave Vanuatu 18 months to reform, and Vanuatu made changes.

But the EU revoked access anyway in December 2024.

Most CBI buyers shrugged.

Vanuatu was 10,000 miles from the Caribbean.

Then the UK came for Dominica.

July 19, 2023, Home Secretary Suella Braverman announced visa restrictions on both Dominica and Vanuatu.

Her words: “Clear and evident abuse of the scheme, including the granting of citizenship to individuals known to pose a risk to the UK.”

The change took effect immediately.

One of the “Caribbean Five” had just lost UK access.

The Caribbean programs scrambled.

St. Kitts reviewed applications. Dominica revoked citizenships from people who had hidden prior UK visa denials.

In March 2024, all five nations signed a Memorandum of Agreement pledging common standards and better screening.

Then came the FATF report.

November 2023, the Financial Action Task Force released its global assessment.

CBI programs were a ‘multi-billion-dollar business to launder the proceeds of fraud and corruption.’

The Caribbean nations protested.

They pointed to their enhanced screening.

Their rejection rates.

Their cooperation with international authorities.

But nothing helped.

The cracks were only starting.

Takeaway: Three years of warning signs (Vanuatu, the UK, the FATF report). The Caribbean assumed better due diligence would protect them.

The Unraveling

Now let’s jump from the Caribbean to Europe for a minute.

The FATF report didn’t just target CBI.

It covered all investment migration, including European Golden Visa programs.

And European governments used that cover to do what they wanted to do for years.

Spain ended its Golden Visa in April 2025.

Portugal removed real estate from its Golden Visa entirely.

Greece raised its Athens threshold from €250,000 to €800,000.

The message was clear:

Europe was done selling access.

Caribbean CBI holders watched all of this happen.

But most weren’t worried.

Why would they be?

The European closures were European governments closing European programs.

That had nothing to do with Caribbean passports.

And the EU hadn’t touched their Schengen access. At least not the way they had with Vanuatu.

The Caribbean programs were older, with longer track records and stronger due diligence.

Then came Norway.

(Note: Norway isn’t in the EU and doesn’t answer to Brussels.)

But Norway is part of Schengen, which means Caribbean passport holders could enter visa-free, same as France or Germany.

In August 2025, Norwegian border officers started asking travelers how they got their passports. If the answer was investment, they got deported.

Norway didn’t wait for the EU to formally suspend anything. It just started saying no.

Any Schengen country can do the same thing tomorrow.

First they shut down their own programs.

Now individual countries are turning away Caribbean passport holders at the border.

The question is, who will follow? And when?

Takeaway: Europe is closing doors to investment migration everywhere.

Stuck on your moving abroad process? You can book an hour with me here.

4 Questions Before You Buy

Look, I’m not here to tell you the sky is falling. Doomsday prophet is not my style.

The CBI industry has real problems, but that doesn’t mean second passports are dead.

It simply means you need to think harder before spending $200,000.

Here are the questions I would ask before buying anything.

1. Do you actually need a passport, or would residency work?

A passport lets you travel. Residency lets you live somewhere.

Most people who think they need a second passport actually need a place to go.

That’s residency, not citizenship.

And residency programs are cheaper than CBI.

If your goal is “have a backup country,” residency might be the better tool.

Understand the difference here:

2. Do you have other paths you haven’t explored?

CBI is the expensive shortcut. But there are other routes.

Ancestry: If you have Italian, Irish, Polish, or Hungarian grandparents (among others), you may qualify for citizenship by descent. It takes time and paperwork, but it’s free or close to it.

Naturalization: Live somewhere for 5-10 years, become a citizen the regular way. Slower, but the passport is bulletproof.

Marriage: Doesn’t apply to everyone, but it’s worth knowing the rules.

Before you wire $250,000 to the Caribbean, make sure you’ve checked the paths that cost nothing (or at least less).

You can check them out here:

3. Who’s advising you, and how do they get paid?

This one matters more than people realize.

Most CBI agents work on commission. Some earn 10-15% of your investment. That’s $20,000 to $30,000 for steering you toward a passport.

If someone only sells CBI, they’ll recommend CBI.

If they get a bigger commission from Grenada than Dominica, guess which one they’ll push.

So, ask how your advisor gets paid.

If the answer is “commission from the program,” get a second opinion from someone who doesn’t.

If you’re interested to do some (unbiased) work with me, you can find more details here.

I’m closing the founding round of the “Retire Abroad Blueprint” which is discounted to $3,500 on February 6th.

4. What happens if access gets revoked?

Maybe this doesn’t even affect your plans that much.

If that Schengen access disappears tomorrow, is the passport still worth it?

For some people, yes.

A Caribbean passport still gets you into 100+ countries. It’s still a real travel document.

For others, no.

If Schengen was the whole point, revocation means you paid six figures for something that no longer does what you bought it for.

Know which camp you’re in before you buy.

That’s it for this week.

Thanks for reading, and as always, appreciate having you here.

— Ben

PS

If you are an American 50+ and want to emigrate within the next 0-5 years, and don’t want to navigate healthcare, banking, visas, taxes and country selection by yourself, reply to this mail with “Retire”.

You’ll get a private invite to the “Retire Abroad Priority List” with some of my best tactics for retiring abroad.

Funny that the EU would ban those with purchased passports but show up on a raft with no documentation of any sort and you are welcomed with open arms.

The visa policy creep here is fasinating because Norway's approach bypasses formal EU coordination entirely just individual enforcement discretion at borders. This creates legal ambiguity that's probably worse than an explicit ban, since CBI holders have no clear timeline or criteria for when access might stabilze. The $22B industry built on 41 years of trust is now discovering that soft power shifts faster than treaties.